News & Media

Market Perspective – Third Quarter, 2025

Financial markets continued to perform well in the third quarter, with equity markets recovering to new highs after the tariff-related selloff ended in April. Bond prices were stable, and the Federal Reserve finally resumed lowering rates as the market expected.

Equity Markets

The S&P 500 rose to a new all-time high in the third quarter, gaining 8.1%. Stocks benefited from solid earnings growth and expanding valuations in anticipation of lower interest rates. The S&P 500 Index is up 14.8% YTD.

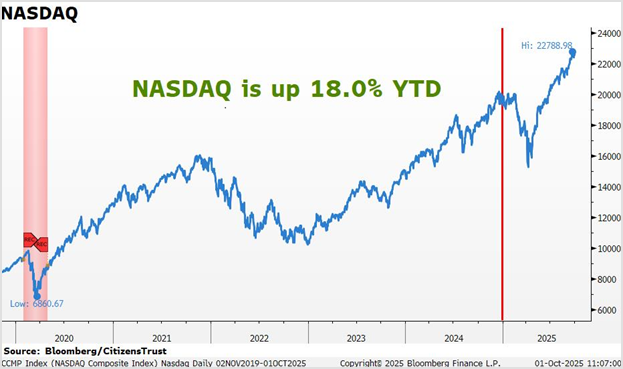

Technology companies continued to lead the market with double-digit gains in both the technology and communication services sectors during the quarter. Spending on artificial intelligence infrastructure has continued unabated with some estimates of 2025 expenditures now exceeding $400 billion. The NASDAQ Composite Index gained 11.4% during the quarter and is now up 18.0% YTD.

For the third quarter, mid-cap stocks, as measured by the Russell Mid-Cap ETF, gained 5.3% and small-cap stocks, as measured by the Russell 2000 Small-Cap ETF, gained 12.5%. Those ETFs are now up 10.2% and 10.4% respectively, YTD. Small-cap stocks marked a new high in September for the first time since late last year, a sign that there was broad participation across sectors in the market.

International equities made gains as well in the third quarter after outperforming domestic equities earlier in the year. International Developed markets, as measured by the EFA ETF, gained 4.5% during the quarter, and are up 25.6% in the first half of 2025. Emerging markets, as measured by the EEM ETF, rose 10.7% in the quarter and are up 28.9% YTD. International equities have benefited this year from a sharp decline in the value of the U.S. dollar. Globally, the MSCI World Index gained 7.5% during the quarter and is up 18.6% this year.

Interest Rates

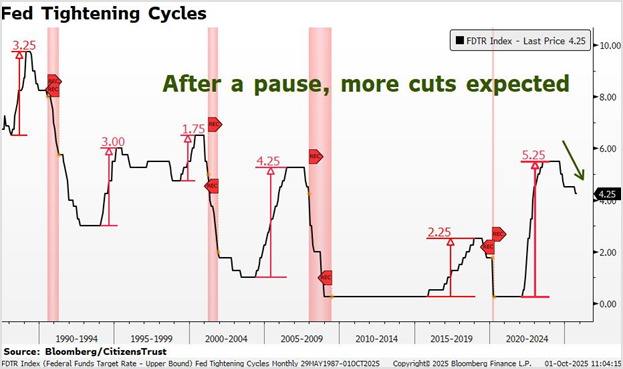

After months of anticipation, the Federal Reserve resumed its easing cycle in September, cutting the Fed Funds rate by 25 basis points. This was the first adjustment since December 2024. This is likely the beginning of a series of rate cuts with the market currently expecting further rate cuts by the end of the year. The Fed now describes their current policy as “modestly restrictive”, suggesting there is room for further rate adjustments if economic developments warrant it.

The Fed remains committed to achieving both maximum employment and bringing inflation down to its arbitrary 2% target. However, Fed Chairman Powell referred to the current situation as challenging because there are some indications that the labor market is weakening while the Fed must also guard against reigniting inflation. While the Fed will depend on incoming economic data to determine the appropriate monetary policy, the government just shutdown on October 1st for an undetermined amount of time. Typically, government shutdowns are short-lived, but that may not be the case this time around.

Considering that there are several labor market indicators not supplied by the government and inflation measures have a significant lag, it is likely that the Fed will become more focused on jobs in the fourth quarter. There is change brewing at the Fed as well. A dovish new governor who dissented in favor of more rate cuts has been added, the Supreme Court ruled that President Trump cannot fire governor Cook yet, and Powell’s potential successor will be named in the months ahead. Chair Powell’s term ends in May of 2026. Further lowering rates, as the market expects, should be supportive of bond market performance. Through the third quarter of 2025 the Bloomberg Aggregate Index, a broad measure of the bond market, has gained 6.1%, a solid start for fixed income investors.

The Economy

The economy continued to recover from tariff and trade disruptions earlier in the year. U.S. GDP in the second quarter rose at a 3.8% annualized rate, and the third quarter is forecast to be greater than 3% as well. The surge in imports intended to avoid future tariff increases should largely be exhausted by now and GDP growth should moderate in the fourth quarter from currently elevated levels. The economic measures of the most importance in the near term will focus on the labor market, inflation, and further tariff announcements. The effects of rising tariffs have thus far been less than feared as many tariffs were negotiated down to lower levels than originally announced. Others were delayed, such as those with China. Tariffs will remain in the headlines with court rulings expected in the coming months that may affect the standing of implemented tariffs.

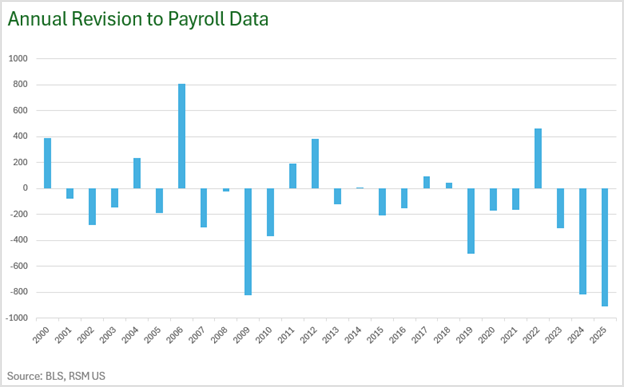

In the case of inflation, Core PCE remains above the Fed’s goal of 2.0%, reported to be 2.9% in recent months. Although higher than earlier in the year, some economists feared that tariffs would spike inflation rates by now. In recent months, most inflation measures have been in-line or slightly better than expected. A more concerning area of the economy is currently the labor market. Although the job market appears stable, hiring intentions have slowed, possibly due to an increase in economic uncertainty. In addition, the Bureau of Labor and Statistics revised downward their previously announced non-farm payroll numbers in September.

It was the biggest revision ever and followed a big negative revision last year. This had the effect of eliminating roughly half of the job growth announced during the twelve months ending March 2025. Big revisions call into question the accuracy of these surveys. Independent labor reports describe a labor market with limited layoffs but also limited hiring intentions.

The economy is benefiting from significant investment in U.S. infrastructure, with AI capital expenditures leading the way. Broad infrastructure spending announcements in the past few quarters have totaled more than a couple of trillion dollars. Consumer spending has also been strong in recent months and points to robust growth in the third quarter. The weakness in the U.S. dollar in the first half of the year lowers the cost of goods to foreign buyers, and this will continue to benefit the U.S. economy.

The Quarter Ahead

Solid economic growth should continue and once the budget dispute is resolved, fiscal policy should remain supportive. The tax bill signed last quarter has already shown growth in tax payment data. The “Big Beautiful Bill” included 100% expensing for capex, domestic R&D, and the building of production facilities, with the provisions retroactive to January. Fiscal stimulus from this bill accelerates into fiscal year 2026 (which began this month) and is forecast to increase GDP growth by nearly one percent.

Corporate earnings have been stronger than expected this year and estimates continue to rise. Typically, earnings estimates begin the year too optimistic and are revised down over the course of the year. That is not the case in 2025. The ten-year average for the third quarter is a negative revision of 3.2%. This year, S&P 500 estimates rose by 0.3% over the same period, evidence that corporate profitability has been robust. As the calendar progresses through the second half of the year, the market will focus more on expectations for 2026 profits which are now above $304 for the S&P 500, up over 13% from 2025 projections. A good economy will support future earnings growth and 2026 has tailwinds from incentives in the recent tax bill, Fed rate cuts, and more deregulatory actions from the current administration.

We look forward to serving you and appreciate the trust you have placed in us. Please reach out to your CitizensTrust representative with any questions you may have.

Learn more about CitizensTrust.

Content provided by: R. Daniel Banis, Executive Vice President, Head of CitizensTrust, and Donald Evenson, Senior Vice President, Chief Investment Officer.

CitizensTrust is a division of Citizens Business Bank. Trust and Wealth Management are provided by CitizensTrust Wealth Management. The information provided is an opinion on economic outlook and not investment advice. The information is not offered with a product or service. This information is not intended to be a substitute for specific tax, legal, or investment planning advice. We suggest that you discuss your specific questions with your qualified tax, legal or investment advisor.

| Not Insured By FDIC or Any Other Government Agency ● Not Bank Guaranteed ● Not Bank Deposits Or Obligations ● May Lose Value |