News & Media

Market Perspective – Second Quarter, 2025

The second quarter of 2025 saw the biggest whipsaw in U.S. stocks in years as markets reacted to near daily tariff and trade announcements. Bond prices rose during the quarter as interest rates fell. The Federal Reserve held rates steady, even as administration officials put pressure on the Fed to lower them.

Equity Markets

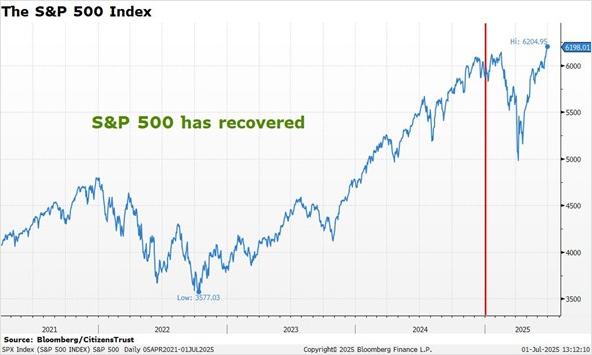

Snapshots in time can be misleading, and if one were to just look at where the S&P 500 finished the second quarter and first half of the year, you might think that not much happened. The market recovered from its mild first quarter pullback of 4% and finished at a new all-time high, about one percent higher than its previous high reached last February. However, in the last few months we have had tariffs announced, tariffs delayed, a 20% market sell-off, a war in the Middle East, and a “Big Beautiful Bill” signed into law. After a relatively low volatility year in 2024, an increase in volatility this year was an easy prediction, and that box can now be checked. Equity markets do not like uncertainty and responded to policy changes by selling off more than 20% between February and early April. Remarkably, it took less than three months from the April bear market lows for the S&P to hit a new all-time high. This was one of the fastest recoveries for U.S. stocks in the last 75 years.

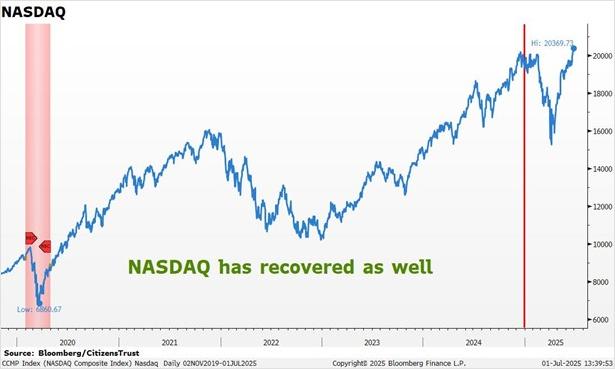

Big technology companies led the sell-off earlier in the year and led the recovery with the NASDAQ Composite Index gaining 18% in the second quarter. Spending on artificial intelligence infrastructure has continued unabated and the front-line beneficiary, semiconductor companies, drove the recovery in the technology sector. The semiconductor ETF (SMH) was up 31.9% during the second quarter.

For the second quarter, mid-cap stocks, as measured by the Russell Mid-Cap ETF, gained 8.4% and small-cap stocks, as measured by the Russell 2000 Small-Cap ETF, gained 8.5%. Those ETFs are now up 4.7% and down 1.9% respectively, YTD.

The outperformance of international equities versus domestic equities continued in the second quarter. International Developed markets, as measured by the EFA ETF, gained 11.3% during the quarter, and are up 20.3% in the first half of 2025. Emerging markets, as measured by the EEM ETF, rose 11.4% in the quarter and are up 16.5% YTD. Globally, the MSCI World Index is up 10.3% this year.

Interest Rates

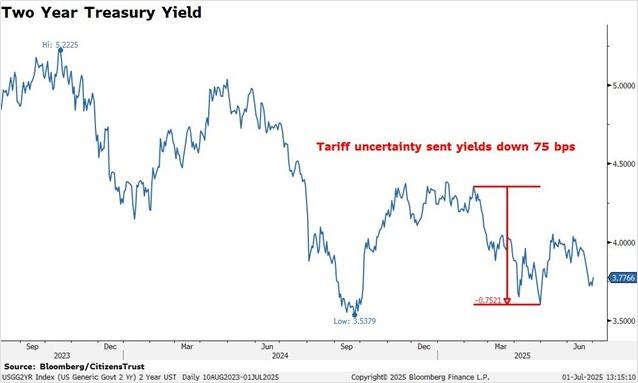

The Fed has taken the position that tariffs can be inflationary even if they are a one-time adjustment, and thus they must “wait and see” before lowering the Fed Funds rate. They describe their current policy as restrictive, yet the desire to see inflation measures closer to their two percent target takes priority. Tariff driven economic uncertainty and slower economic growth sent the yield on two-year treasury bonds down 75 basis points this spring, yet the market does not expect a rate cut until this fall.

While Fed Chairman Powell has remained steadfast in his patient approach, dissent among Fed governors has increased, as reflected in the recent Fed meeting and public remarks. In addition, the displeasure with high rates expressed by administration officials from the President on down has ramped up in recent months. Treasury Secretary Scott Bessent had advocated for lower yields on the ten-year Treasury bond but has shifted his focus to short-term treasuries and stated that debt refinancing will take place at the shorter end of the Treasury curve. Higher interest expenses are straining the federal budget and the push for lower interest rates will likely continue for the foreseeable future. President Trump has discussed a plan to name Powell’s successor well in advance of the end of his tenure as chairman which ends in May of 2026. In the first half of 2025 the Bloomberg Aggregate Index, a broad measure of the bond market, gained 4.0%, for a solid start for fixed income investors.

The Economy

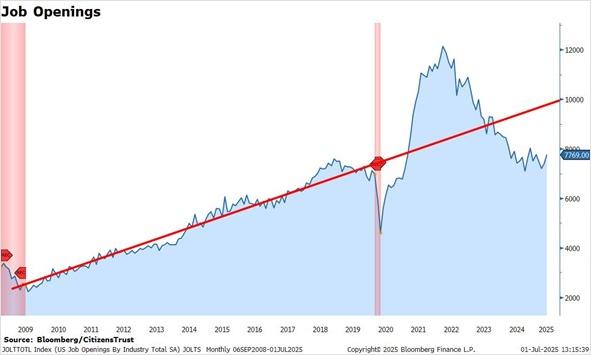

The economy appeared to be just as volatile as equity markets in the first half of the year. U.S. GDP in the first quarter declined at a 0.5% annual rate, but industrial production expanded at a 4.5% annual rate in the very same quarter. The quarterly decline in GDP was caused by tariff induced front-running. Excluding the surge in imports, economic activity continued to grow. GDP growth is expected to have rebounded in the second quarter as tariff disruptions to imports reverse. GDP growth will resume and will likely be overstated when estimates are released in late July. Policy changes have economic implications and tariffs are not alone in disrupting economic measurements. The crackdown on illegal immigration appears to be affecting several labor statistics. A rise in job openings and a declining unemployment rate would normally be viewed as signs of a strong job market. However, it appears that workers without legal status are leaving the country which is creating job openings and has caused a drop in the labor force last month, which lowers the unemployment rate. At the same time, private payroll gains have been relatively modest and continuing unemployment claims are at a two-year high, indicating job market weakness.

A tail wind for the U.S. economy in the second half of the year will come from recent weakness in the U.S. dollar. After peaking in January, the dollar has weakened relative to other major currencies by a trade-weighted amount of roughly 12%. That’s a big move for the reserve currency of the world, and the weakest first half performance of the dollar in 52 years. This will have the effect of making U.S. goods cheaper to foreign buyers and should increase exports in the coming months. Roughly 40% of S&P 500 corporate revenues are generated outside the U.S.

The Quarter Ahead

The reconciliation bill was signed into law on July 4th and removes a significant amount of fiscal and tax uncertainty for the foreseeable future. Significant changes to business tax provisions will benefit investment in coming quarters. The Administration will now turn its attention to trade deals, with several deadlines approaching in August. A few trade deals have been announced (U.K., Vietnam) and more will likely come in the third quarter. Investors are gaining more certainty with both fiscal policy and tariffs.

We expect the economy to remain resilient in the third quarter even though GDP growth may be below average due to tariff adjustments. With the Fed on hold with its restrictive policy it is important to remember that a monetary policy that is tight enough to slow inflation is also tight enough to slow the economy. Corporate earnings expectations for 2025 were revised down in the first half of the year by 3.6%, a pace that is just slightly worse than average. If anything, it is surprising that revisions have not been worse given the increased levels of uncertainty. As the calendar progresses through the second half of the year, the market will focus more on expectations for 2026 profits which currently stand at $300 per share for the S&P 500, up over 13% from 2025 projections. The market is looking past short-term tariff adjustments and will likely benefit from a less uncertain second half of the year.

We look forward to serving you and appreciate the trust you have placed in us. Please reach out to your CitizensTrust representative with any questions you may have.

Learn more about CitizensTrust.

Content provided by: R. Daniel Banis, Executive Vice President, Head of CitizensTrust, and Donald Evenson, Senior Vice President, Chief Investment Officer.

CitizensTrust is a division of Citizens Business Bank. Trust and Wealth Management are provided by CitizensTrust Wealth Management. The information provided is an opinion on economic outlook and not investment advice. The information is not offered with a product or service. This information is not intended to be a substitute for specific tax, legal, or investment planning advice. We suggest that you discuss your specific questions with your qualified tax, legal or investment advisor.

| Not Insured By FDIC or Any Other Government Agency ● Not Bank Guaranteed ● Not Bank Deposits Or Obligations ● May Lose Value |