News & Media

Market Perspectives – First Quarter, 2023

CitizensTrust – A Division of Citizens Business Bank

Click on images below to enlarge.

Financial markets rose in the first quarter of 2023 marking a second quarter of price increases since the fall of last year. Equities and bonds rose during the quarter as inflation measures continued to decline and the Fed approached the end of its tightening cycle.

Equity Markets

The S&P gained 7.5% in the first quarter and has recovered over 14% from the lowest levels of last year which occurred in October. While technology-related stocks led the market lower last year, the first quarter saw a reversal of that trend as the technology sector outperformed. The technology and communications sectors make up roughly 30% of the S&P 500 Index.

The S&P gained 7.5% in the first quarter and has recovered over 14% from the lowest levels of last year which occurred in October. While technology-related stocks led the market lower last year, the first quarter saw a reversal of that trend as the technology sector outperformed. The technology and communications sectors make up roughly 30% of the S&P 500 Index.

Mid-cap stocks, as measured by the Russell Mid-Cap ETF, rose 3.9% during the quarter and small-cap stocks, as measured by the Russell 2000 Small-Cap ETF, gained 2.7% during the quarter. Smaller companies lagged the overall market significantly.

Outside the U.S., International Developed markets, as measured by the EFA ETF, rose 9.8% during the quarter driven by European equities that continued to recover from disruptions caused by the conflict in Ukraine. Emerging markets, as measured by the EEM ETF, were up 4.3% for the quarter. Globally, the MSCI World Index has gained 8.0% through the end of March for a solid start to the year.

Interest Rates

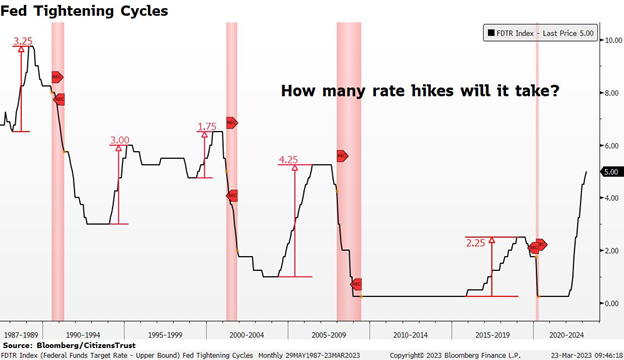

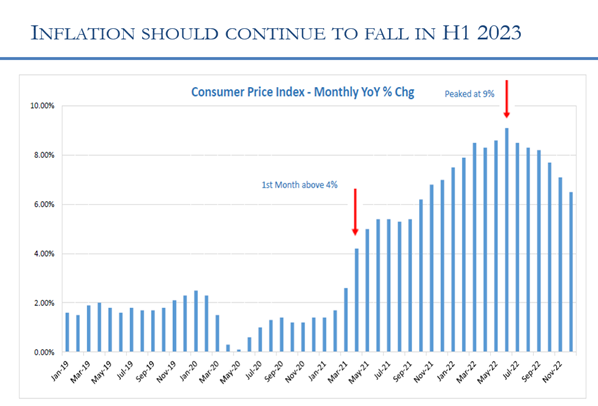

The Fed Funds rate began the year at 4.5% and the Fed increased rates by 25 basis-points at both of their first quarter meetings. The current level of 5.0% is the highest it has been since 2007. A year ago, the Fed was notably late to move to a more restrictive monetary policy and made up for lost time over the course of 2022 with several rate hikes, including some as high as 75 basis-points. The pace has now slowed and it appears the Fed is at, or near, the end of this tightening cycle. Multiple Inflation measures have declined from their peak levels of last year, but none have declined fast enough in the eyes of policy makers. It is well understood that monetary policy acts with a significant lag and, after twelve months of the quickest and largest rate increase in over 40 years, the effects of a now restrictive policy should begin to take hold.

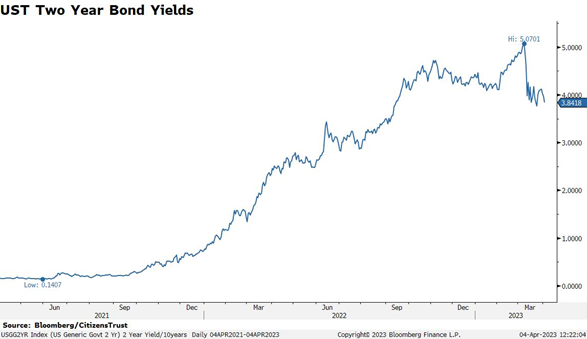

Chairman Powell would like to keep rates “higher for longer” until he is confident that persistently high inflation has been rooted out of the economy. The Fed’s number one mandate is “price stability” and they have failed miserably at this recently. The Fed spent most of the first quarter promoting the message that the Fed Funds terminal rate would be higher than the market expects. That messaging pushed the yield on the two-year U.S. Treasury bond above five percent. However, balance sheet issues at several banks sent reverberations throughout financial markets, spiked bond volatility, and disrupted the Fed’s plan. Once again, despite an increase in the Fed Funds rate during the quarter, the two-year U.S. Treasury yield has fallen sharply and is now below 4%.

The decline in the two-year bond yield is a tell-tale sign that the bond market firmly believes this rate hike campaign is over. After the banking crisis emerged in March, further rate hikes were removed from the futures curve and the market now expects the Fed to be cutting interest rates at some point later this year. The decline in yields during the first quarter drove the Bloomberg Aggregate Index, a broad measure of the bond market, up 3.0%.

The Economy

U.S. GDP growth has remained steady in recent quarters and the first quarter of 2023 appears no different. The economic disruptions and fiscal support of the recent past have made the economy dangerously insensitive to the Fed’s rate hikes. The pent-up demand, supply chain driven backlogs, and fiscal stimulus of the past few years are all winding down to a large extent. Slower than baseline economic growth will likely be the case in the near term. The yield curve has spent the last 9 months solidly inverted, but that trend appears to have abruptly changed.

An inverted yield curve that is steepening is a signal to the Fed that the market believes the Fed has tightened enough. In addition, many leading economic indicators suggest that the economy has cooled off and the post-pandemic excesses have largely worn off. Consensus GDP growth estimates for the next several quarters currently suggest very little growth for the rest of 2023. The severity of any slowdown will be gauged by the labor market. Thus far, the labor market has been resilient. Job creation has been strong, and unemployment remains low. This is good news for the economy and will help offset the restrictive effects of higher interest rates.

The Quarter Ahead

Rising inflation was the economic story of 2022. The Consumer Price Index, which is a broad measure of inflation, peaked last June. Inflation should continue to fall for the next several months bringing the Fed some relief. At some point this quarter, the Fed Funds rate will be above the current inflation rate, which many economists believe is a requirement to control inflationary pressures. This dynamic will bring us closer to a Fed “pause.”

Investors will remain focused on future inflation readings and any increases in weekly unemployment claims. A significant rise in unemployment claims will precede a rising unemployment rate. Corporate earnings expectations have declined this year, but overall, profits have held up relatively well which has been supportive of equity markets. In the fixed income markets, whenever the Fed ends up lowering rates, bond prices will respond accordingly. Volatility is likely to remain high and we expect opportunities to arise as the market adjusts to this higher-rate environment.

We look forward to serving you and appreciate the trust you have placed in us. Please reach out to your CitizensTrust representative with any question you may have.

Learn more about CitizensTrust