News & Media

Market Perspectives – Fourth Quarter, 2023

CitizensTrust – A Division of Citizens Business Bank

Click on images below to enlarge.

Financial markets around the globe rallied sharply during the fourth quarter. Both bonds and stocks saw impressive gains to finish the year on a strong note. After a pullback lasting several months leading up to November, the market’s change in direction was prompted by the Federal Reserve signaling that their rate hiking cycle was over.

Equity Markets

The S&P 500 Index rose 11.7% in the fourth quarter and finished the year with a total return of 26.3%. The sharp rally in the last two months of the year more than doubled S&P 500’s gain for the year.

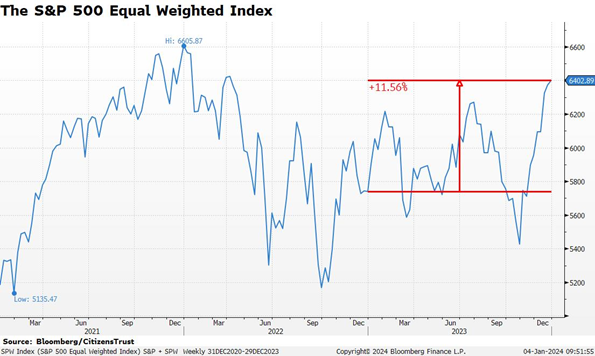

The big technology companies continued to be some of the best performers for the year. The Nasdaq 100 (ETF is QQQ) gained nearly 55% in 2023. However, during the fourth quarter, one aspect of the market that changed abruptly was the participation of small and mid-cap companies. As equity market breadth increased, smaller companies outperformed. This was undoubtably triggered by the decline in interest rates and the fourth quarter saw a significant rise in the equal-weighted S&P 500 as a result.

For the fourth quarter, mid-cap stocks, as measured by the Russell Mid-Cap ETF, rose 12.7% and small-cap stocks, as measured by the Russell 2000 Small-Cap ETF, rose 14.0%. For 2023, mid-cap gained 17.1% and small-cap gained 16.8%, still under-performing the S&P 500 by a significant margin.

The U.S. market continued to outpace international indices during the fourth quarter. International Developed markets, as measured by the EFA ETF, rose 10.7% during the quarter and gained 18.4% for the year. As with smaller companies, the international markets could not keep up with gains made by the largest U.S. tech companies. Emerging markets, as measured by the EEM ETF, were up 8.0% for the quarter and finished the year up 9.0%. Emerging markets were negatively affected by the poor performance of Chinese domiciled equities which make up a large portion of the index. Globally, the MSCI World Index gained 11.2% in the fourth quarter and posted a total return of 22.3% for the year.

Interest Rates

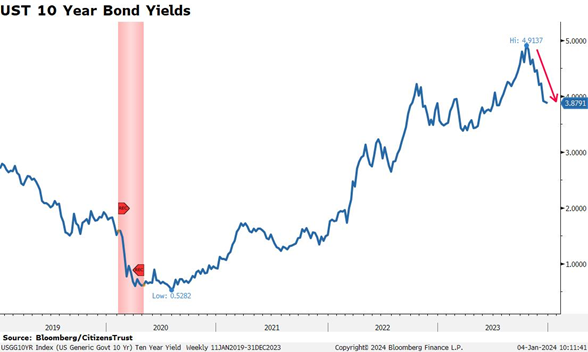

The fixed income market also rallied significantly in the fourth quarter. Interest rates rose throughout the year and the ten-year U.S. Treasury yield peaked just below 5% in late October ahead of the November 1st Fed meeting. The Federal Reserve had been consistent with its intent to keep interest rates “higher for longer” throughout the summer and fall. That messaging changed in November when Fed chair Powell left rates unchanged for a second time and went on to suggest in December that the Fed may be cutting rates at some point in 2024. This led to a 100 basis-point drop in yields and the sharpest bond rally in over 40 years.

The Fed had already slowed the pace at which they were hiking the Fed Funds rate, and it now appears that the last hike was at their July meeting. From the beginning of the tightening cycle in March of 2022, the 5.25% increase in the Fed Funds rate is the sharpest increase in more than 40 years. Since the process began from zero, it is likely that the lagging effects of higher rates on the economy will be longer this time, and the Fed is at the point where they want to be patient. The two-year U.S. Treasury bond responded accordingly, and the yield dropped nearly 100 basis points as well.

As yields fell across the treasury curve during the fourth quarter, rising bond prices allowed the Bloomberg Aggregate Index, a broad measure of the bond market, to more than recover its YTD losses through the third quarter. The bond market gained 6.8% in the fourth quarter, pushing the index well into the black with a total return of 5.7% for 2023.

The Economy

U.S. GDP growth was stronger than expected in the second half of 2023. Third quarter growth was 4.9% and the fourth quarter is expected to be above 2%. A simple review of 2023 economic indicators would conclude that many broad measures of the economy normalized after a period of unprecedented gyrations during 2020 to 2022. GDP growth is slightly above its longer-term trend, job growth has been steady and is at roughly normal pre-pandemic levels, and inflation has receded most of the way back towards the Fed’s target. The failure of a recession to emerge in 2023 and continuing economic growth have increased the prospects for a so-called “soft landing” for the economy, where economic growth slows but does not tip into a contraction.

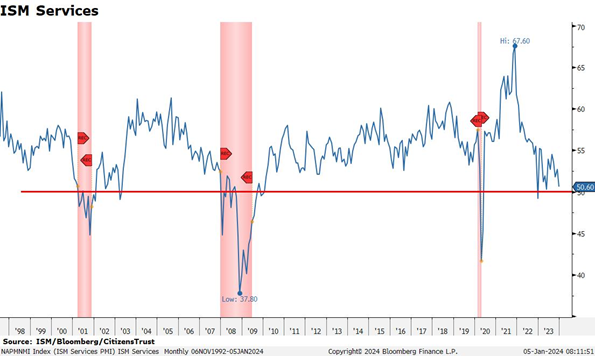

The services sector is the largest segment of the U.S. economy and is less cyclical and volatile than the manufacturing sector. As measured by the ISM Services index, the indicator was above 50, indicating expansion, for every month during 2023. This is the opposite of the ISM Manufacturing index, which spent every month of 2023 below 50, indicating contraction. The services sector is significantly larger than the manufacturing sector and more than offset the weakness in manufacturing. However, this indicator will be watched closely in 2024 as any break below 50 for an extended period of time is a timely indicator of an economic contraction.

Regardless of the current state of the economy, the ongoing “recession watch” will continue due to the fact that monetary policy remains restrictive as we enter the new year. Interest rates are now well above inflation rates, the Fed’s balance sheet is forecast to shrink in 2024, and lending by financial institutions is at relatively low levels. Offsetting restrictive Fed policy is an enormous amount of fiscal deficit spending that is expected to continue in 2024. The Congressional Budget Office projects that deficit spending in FY 2024 will remain around six percent of GDP, which is relatively high in comparison to the past.

The Quarter Ahead

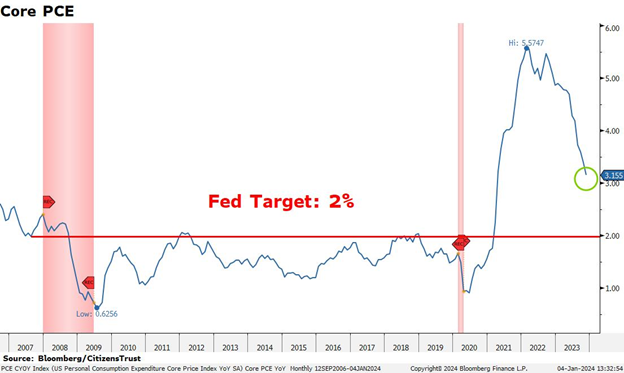

Inflation will continue to be the most important economic measure that investors are focused on. For the Fed to start cutting rates and move toward a neutral monetary policy position, they must first declare their war on inflation as “mission accomplished.” The Fed’s primary focus has been on fighting inflation for two years now. The Fed’s preferred measure of inflation, Core PCE, continues to approach the Fed’s 2% target. Any meaningful uptick in PCE during 2024 will throw water on the market’s expectations for future rate cuts.

Investors will also be watching the labor market closely. The Fed has stated that they would like to see a weaker job market which relieves wage pressure and thus inflation. Labor market indicators have softened recently, basically falling to normal levels from very tight conditions.

Corporate earnings and profit margins have remained resilient throughout this tightening cycle. Earnings growth is expected to accelerate this year after being flat in 2023. The recent decline in longer-term interest rates bodes well for the more rate-sensitive sectors of the economy such as housing and autos. U.S. corporate earnings, in comparison to other developed economies, are expected to deliver relatively strong growth rates in future quarters.

We look forward to serving you and appreciate the trust you have placed in us. Please reach out to your CitizensTrust representative with any questions you may have.

Learn more about CitizensTrust