News & Media

Market Perspectives – Second Quarter, 2023

CitizensTrust – A Division of Citizens Business Bank

Click on images below to enlarge.

Equity markets continued to rise in the second quarter of 2023 and posted a solid start to the first half of 2023. Bond prices pulled back slightly in the quarter as interest rates recovered from the banking concerns that arose in March and the economy remained strong.

Equity Markets

The S&P rose 8.7% in the second quarter and has gained 16.9% year-to-date. A common definition of a “bull market” is when a market has a 20% rally that was preceded by a 20%+ decline. The S&P 500 crossed that threshold in June and is now up 24% from last October.

Technology was the best-performing sector in the first half which saw several of the largest technology companies hit new all-time highs. The technology sector ETF (XLK) was up over 40% and the broader NASDAQ Composite Index gained 32.3% year-to-date. The largest technology company, Apple (AAPL) reached a market value milestone of $3 trillion for the first time in history. The technology and communications sectors now make up 35% of the S&P 500 Index.

Despite the dominating performance of large-cap technology in the first half, the market began to broaden out in June when smaller-cap companies outperformed the S&P 500 during the month. For the second quarter, Mid-cap stocks, as measured by the Russell Mid-Cap ETF, rose 4.7% and small-cap stocks, as measured by the Russell 2000 Small-Cap ETF, gained 5.3%. On a YTD basis, mid-cap is up 9% and small-cap is up 8%, representing roughly half the performance of the S&P 500 (+16.9%).

Outside the U.S., International Developed markets, as measured by the EFA ETF, rose 3.3% during the quarter, lagging the U.S. markets. Emerging markets, as measured by the EEM ETF, were up 1.0% for the quarter. Globally, the MSCI World Index gained 14.2% in the first half of 2023 for a solid start to the year.

Interest Rates

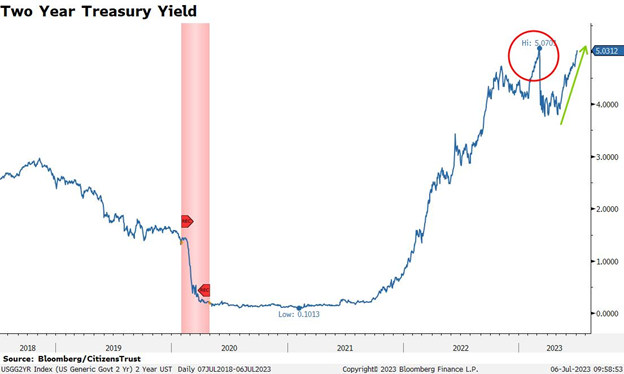

The Fed Funds rate was raised as planned in early May to 5.25%, however, the Fed chose to not hike again at their June meeting as they assessed the potential fallout from issues in the banking sector. Several high-profile bank failures put pressure on Regional Banks which raised concerns that credit availability would tighten. Despite the Fed’s decision to skip a hike, they increased their forward guidance for further rate hikes from one to two. The two-year U.S. Treasury bond responded accordingly, and the yield has risen back to where it was before the banking concerns surfaced in March.

The Fed spent most of the first quarter arguing that the Fed Funds terminal rate would be higher than the market expects, and they have recently returned to this messaging. With this year’s banking issues contained for now, Fed Chairman Powell has resumed his “higher for longer” narrative with regard to interest rates. The Fed has reiterated that their priority is to bring down persistently higher inflation rates. They have cited the extremely tight labor market as a primary contributor to inflation and are looking to weaken the job market.

The recovery in yields during the first quarter put pressure on bond prices and had the Bloomberg Aggregate Index, a broad measure of the bond market, down 0.8% for the second quarter reducing its YTD gain to 2.1%.

The Economy

U.S. GDP growth continues to be strong in 2023. The growth rate in the first quarter was revised higher to 2.0% and, as of this writing, the Atlanta Fed’s forecast for the second quarter is tracking at 2.1%. This solid economic performance is in stark contrast to the persistent calls for an imminent recession that were widely noted at the beginning of this year.

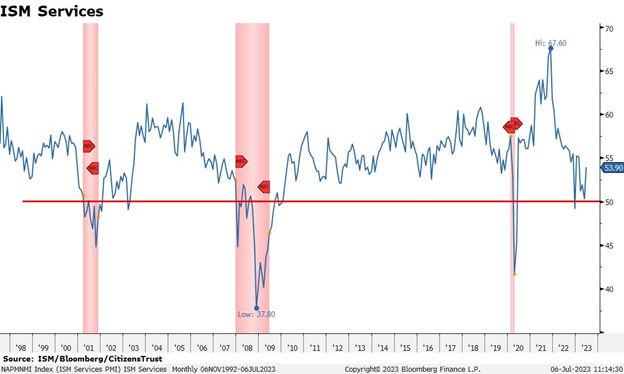

The U.S. economy’s insensitivity to higher interest rates remains intact at mid-year. Job growth has been strong this year and the tight labor market is still unwinding distortions caused by our pandemic response. Interest rate sensitive portions of the economy such as housing and auto sales have been remarkably resilient to higher financing costs. Housing demand and auto sales have been steady and have yet to show signs of slowing down. Spending on services is the largest contributor to economic growth and the closely watched ISM Services survey has not fallen below 50, which would signal contraction.

GDP growth estimates for the next several quarters forecast slower economic growth than recent quarters, but revisions to those estimates have been trending higher. The labor market is the backbone of economic growth and, so far, job creation has been strong during this tightening cycle. Even the typically volatile and rate sensitive construction industry has continued to hire people in this higher interest rate environment. Throughout the second quarter, the majority of economic releases were surprisingly strong and point to continued economic growth in the near-term.

The Quarter Ahead

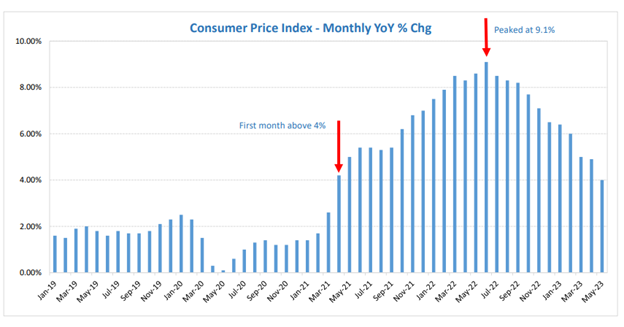

Rising inflation was the economic story of 2022, and in the first half of 2023 falling inflation has been well received. However, the most difficult period in the fight against inflation lies ahead. The Consumer Price Index, which is a broad measure of inflation, rose quickly to its peak of 9.1% in June of 2022. This year it has fallen to 4% and will likely see another large drop in July, possibly to levels near or below 3.0%.

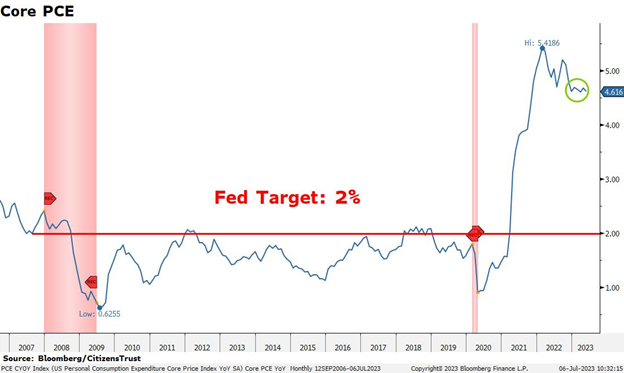

However, because we are now 12 months into these elevated inflation reports, the comparisons will get more difficult during this quarter and that will make it harder for inflation to continue to fall at the pace it has been. A less volatile measure of inflation, Core Personal Consumption Expenditures (which is the Fed’s preferred measure of inflation), has been stickier and has not significantly declined. This measure of inflation is well above the Fed’s 2% target. If the decline in CPI stalls later this quarter, the Fed’s target of 2% Core PCE will appear more difficult to achieve than many had hoped. This would be supportive of Chairman Powell’s “higher for longer” approach.

Throughout the second half of 2023 the Fed Funds rate will be above the current inflation rate, which signals a restrictive monetary policy. This dynamic has not been in place for several years and should eventually slow the economy and bring us closer to a Fed “pause”.

Investors will also be focused on any signs of weakness in the labor market. The weekly Initial Jobless Claims report, the monthly Non-Farm Payroll survey and the unemployment rate have continued to show strength throughout this tightening cycle. If any of those measures begin to reverse their current trend, it will be a sign that the Fed is done. At that point, investors can debate whether it will be a hard or soft landing for the economy, but until then economic growth continues.

We look forward to serving you and appreciate the trust you have placed in us. Please reach out to your CitizensTrust representative with any questions you may have.

Learn more about CitizensTrust